Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

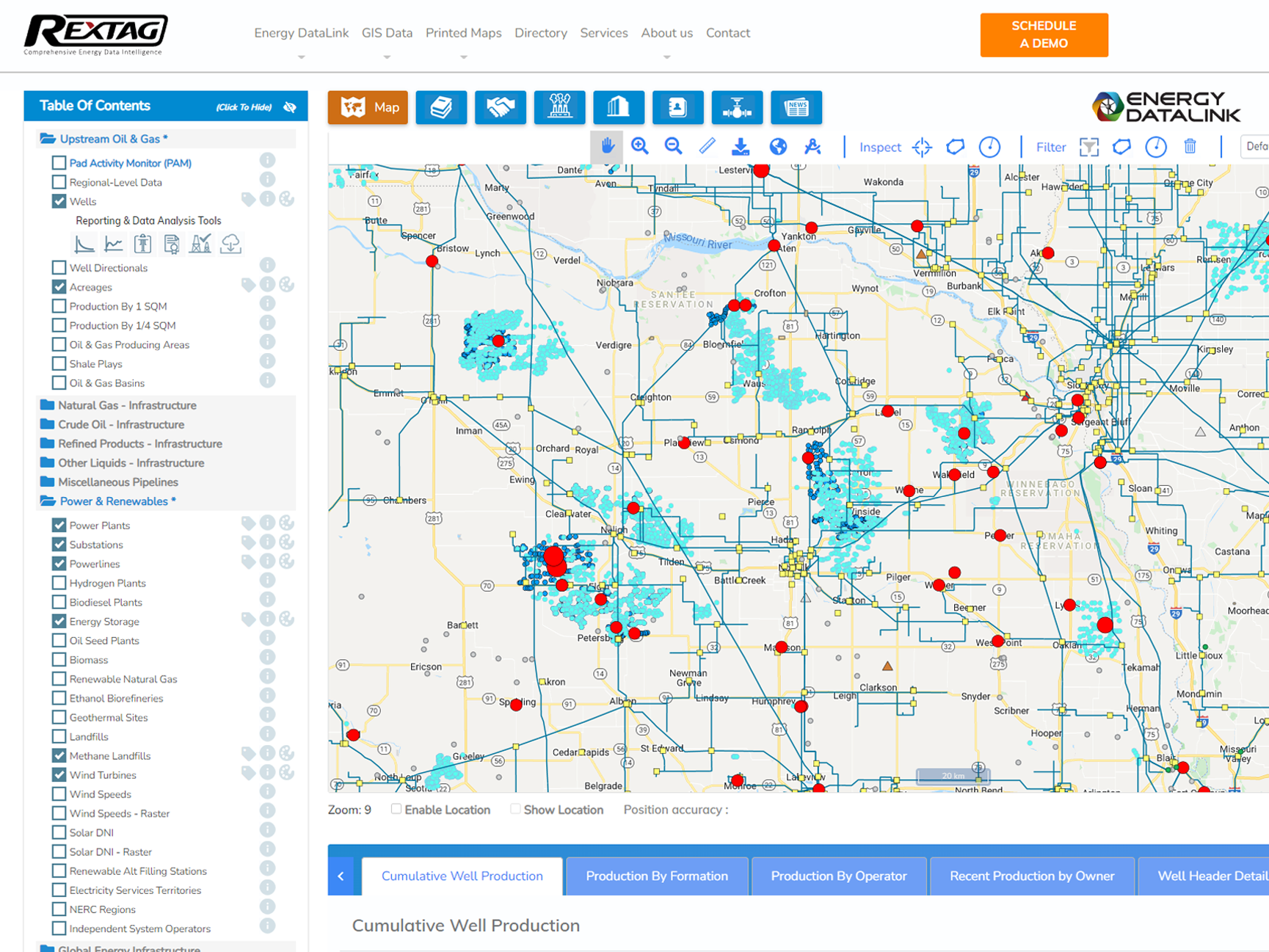

Co-Location Energy Infrastructure Analysis at Your Fingertips

Your team’s ESG performance can be greatly improved applying the asset co-location analysis within upstream or midstream use cases. This has been a topic for a discussion at Rextag’s ‘Is ESG Improvement Next Door?’ webinar. We reviewed some cases like curbing gas flaring or renewable energy sourcing to power the fossil fuel infrastructure. Many combinations are available with access to the data Rextag provides on wells, acreages, power lines, substations, and such renewable infrastructure as wind turbines, methane landfills, etc.

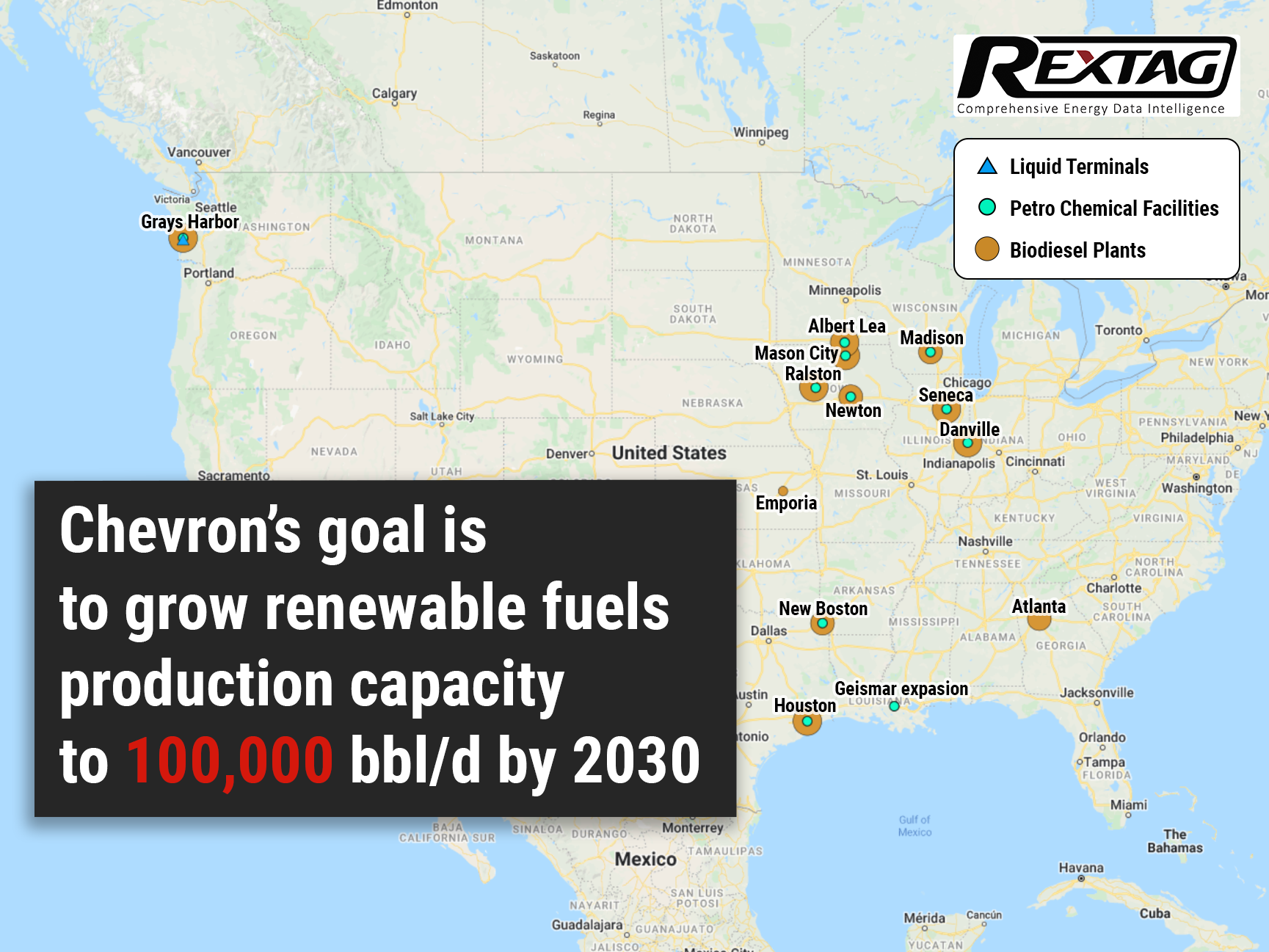

All-in: Chevron Invests $3 Billion in Alternative Fuels

With the purchase of Renewable Energy Group Inc. for $3.15 billion, Chevron makes its largest investment in alternativefuels. This turn in investments highlights the shift in the world’s attitude toward climatechange. Since oil companies contribute heavily to global #emissions, governments and investors are increasingly urging them to reduce their #carbonfootprints and join the fight against emissions. As state and federal subsidies to decarbonize fuels increase, U.S. refineries have likewise increased the production of renewable diesel. In line with this, by 2050, Chevron aims to cut gas emissions to zero.

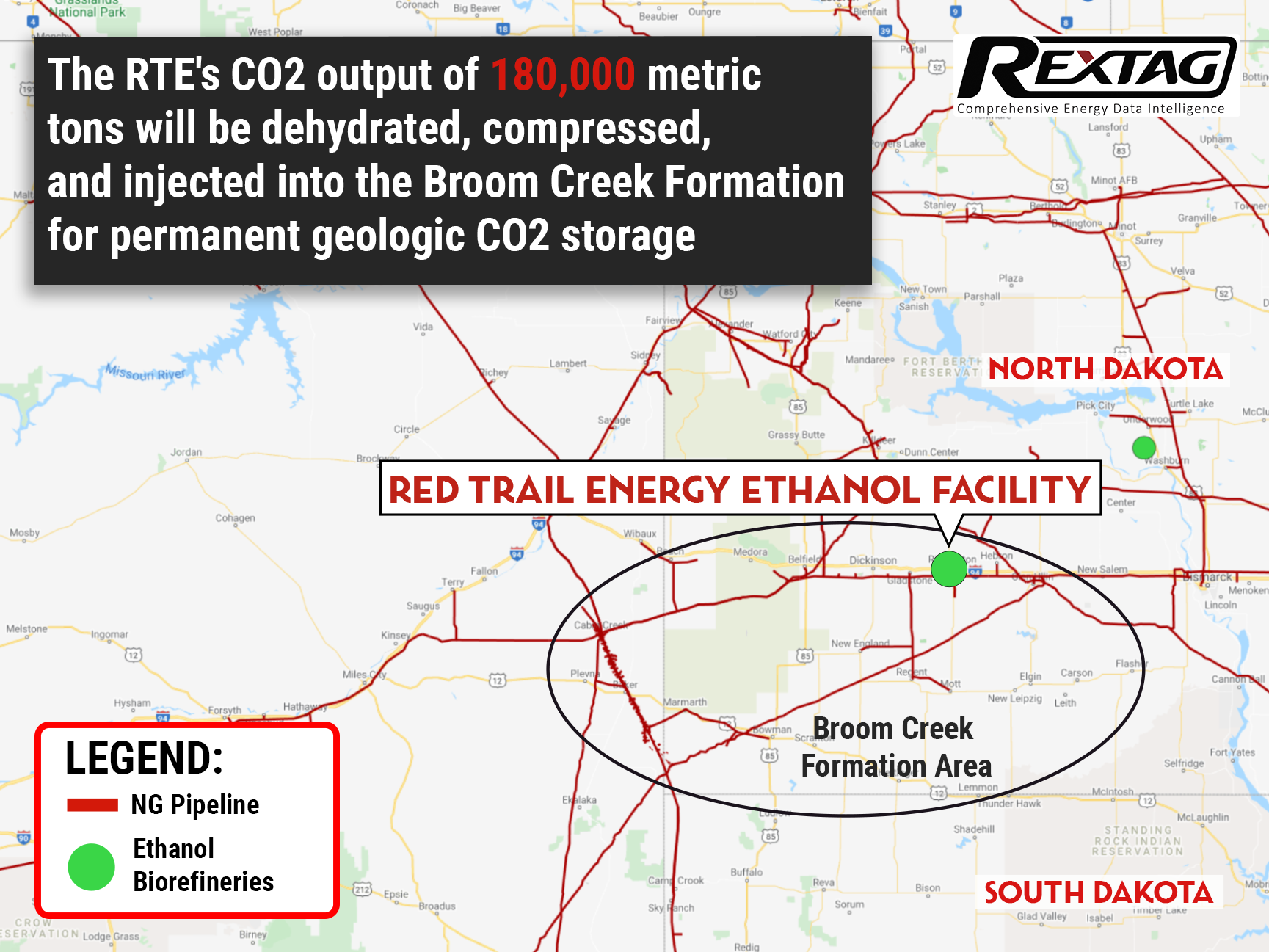

The race for landmark CCS project: North Dakota approves Class VI well for Red Trail Energy

New standards for carbon capture have been set in North Dakota earlier this month as NDIC greenlights Red Trail Energy’s project. The company will now be able to commercially capture, compress, and inject 180,000 tons of carbon dioxide per year into the Broom Creek Formation on its property for permanent geologic CO2 storage. This ensures that carbon dioxide can be stored safely for generations to come.